This comprehensive analysis by Biltrax Construction Data examines Roads & Highways sector developments across the North, East, and West Zones for FY 2024-25. Leveraging data from the BX-2 platform, the report highlights the significant trends and the leading players driving construction activities in these regions.

As India accelerates its infrastructure journey, the Roads & Highways sector continues to be a cornerstone—boosting connectivity, fueling economic momentum, and unlocking regional potential. This in-depth ‘Zonal Analysis: Series 4’ explores the key developments, trends, and initiatives shaping the Roads & Highways sector across three significant regions: North, East, and West India.

The series will offer detailed insights into major projects, investments, and policy initiatives during FY 2024-25, contributing to the growth and modernization of India’s road network.

Overview

In FY 2024–25, the North Zone emerged as a key driver of cross-border connectivity and all-weather access to the Himalayan states. The government advanced the Bharatmala Pariyojana’s Himalayan corridors, with projects such as the Delhi–Amritsar–Katra Expressway and upgrades to the Manali–Leh and Srinagar–Kargil routes. These further ensured faster movement of goods and tourists across difficult terrains. With over 1,200 Km of highways under construction in Jammu & Kashmir, Himachal Pradesh, and Uttarakhand, the region is being more closely integrated with national economic corridors, further strengthening both border trade and tourism-linked infrastructure.

During FY 2024–25, the East Zone continued to strengthen connectivity between industrial hubs, mining belts, and ports, supporting regional trade and exports. Key highway projects advanced under the Gati Shakti and Bharatmala initiatives during this period. These included the Kolkata–Siliguri Expressway in West Bengal, four-laning of sections like Balasore–Jharpokharia and Chandikhole–Paradip in Odisha, and improvements along the Ranchi–Tata NH-33 corridor in Jharkhand. These projects not only improved port-linked logistics and industrial connectivity but also enhanced access to the Northeast and eastern hinterlands. By integrating key economic corridors with national highways, the East Zone solidified its role in resource-based and trade-driven infrastructure development.

During the same financial year, the West Zone stood out for its scale of expressway and corridor development. This further reinforced the zone’s role as India’s logistics and industrial backbone. The region saw major progress on the Mumbai–Delhi Expressway, along with feeder routes across Gujarat and Rajasthan that link industrial clusters to ports and metro cities. Maharashtra accelerated work on port-connectivity highways and urban ring roads. Meanwhile, Gujarat advanced corridors supporting petrochemical and manufacturing hubs. These initiatives collectively strengthened freight efficiency and regional integration, positioning the West Zone as a benchmark for highway-driven economic growth.

Also Read: India’s Construction Industry in FY 2024-25: A Zone-Wise Analysis

A. NORTH ZONE

Construction Projects in the North Zone

In the last financial year, Biltrax tracked 70 Roads & Highways projects in the North Zone through its BX-2 platform, with an estimated construction cost of 25,755 INR-Crore. Out of the 70 Roads and Highways projects identified in the North Zone, 67 were in the early stage of development, while 3 were in the under-construction stage. This also includes projects focused on upgrading existing road segments and minor structural enhancements.

State-wise Construction Overview of the North Zone

Of the total projects tracked by BX-2 in the North Zone during FY 2024-25, Uttar Pradesh stood out with the highest construction value. The state undertook 19 projects with a combined construction cost of 9,412 INR-Crore, accounting for 36.54% of the total. These projects include developing new roadways, constructing underpasses and bridges, expanding existing roads, and enhancing road infrastructure.

| Sr. No. | State | Project Nos. | Construction Value (INR-Crore) |

| 1 | Uttar Pradesh | 19 | 9,412 |

| 2 | Punjab | 8 | 5,579 |

| 3 | Rajasthan | 21 | 4,944 |

| 4 | Himachal Pradesh | 5 | 1,793 |

| 5 | Uttarakhand | 6 | 1,572 |

| 6 | Haryana | 5 | 920 |

| 7 | Jammu & Kashmir | 2 | 562 |

| 8 | Ladakh | 2 | 421 |

| 9 | Chandigarh | 1 | 310 |

| 10 | Delhi | 1 | 242 |

| Total | 70 | 25,755 |

State-wise Construction Overview of the North Zone (Based on Construction Value)

Key Stakeholders in the North Zone

This section highlights the key stakeholders driving road infrastructure activities in the North Zone during FY 2024-25. It focuses on major project owners and top contractors leading significant regional developments

Major Project Owners

As of FY 2024-25, BX-2 tracked leading project owners in the North Zone. Of these, the National Highways Authority of India (NHAI) alone accounted for over 59.68% of the total construction value. In addition to NHAI, the Ministry of Road Transport and Highways (MoRTH) oversaw 16 projects worth 5,831 INR-Crore, contributing 22.64% of the North Zone’s total construction value in FY 2024–25

| Sr. No. | Company Name | Project Nos. | Construction Value (INR-Crore) | % by Construction Value |

| 1 | National Highways Authority of India (NHAI) | 42 | 15,370 | 59.68% |

| 2 | Ministry of Road Transport and Highways (MORTH) | 16 | 5,831 | 22.64% |

Top General Turnkey/Civil Works Contractors

Biltrax’s BX-2 platform tracked 9 contractors during FY 2024-25 in the North zone, involved in 10 roads and highways projects. These carried an accumulated construction cost of 3,106 INR-Crore. Kaluwala Construction Company Private Limited emerged at the top, spearheading projects worth more than 965 INR-Crore. This represented nearly 31.07% of the total cost. M G Contractors Private Limited and Raj Shyama Constructions Private Limited followed in the second and third ranks, respectively. These firms are delivering projects worth 680 INR-Crore and 305 INR-Crore, respectively.

| Sr. No. | Company Name | Project Nos. | Construction Value (INR-Crore) | % by Construction Value |

| 1 | Kaluwala Construction Company Private Limited | 2 | 965 | 31.07% |

| 2 | M G Contractors Private Limited | 1 | 680 | 21.89% |

| 3 | Raj Shyama Constructions Private Limited | 1 | 305 | 9.82% |

Additionally, BX-2 identified over 54 awarded contracts in the North region for FY 2024-25 with a combined awarded value of 29,693 INR-Crore and a total road length of 1,204 Km.

B. EAST ZONE

Construction Projects in the East Zone

In FY 2024-25, Biltrax, through its BX-2 platform, tracked 61 Roads & Highways projects in the East Zone, with an estimated construction cost of 32,056 INR-Crore. Out of the 61 Roads and Highways projects identified in the East Zone, 53 were in the early stage of development, while 8 were under construction. This also includes projects focused on upgrading existing road segments and minor structural enhancements.

State-wise Construction Overview of the East Zone

Of the total projects tracked by BX-2 in the East Zone during FY 2024-25, Odisha stood out with the highest construction value. The state undertook 23 projects with a total construction cost of 16,552 INR-Crore, accounting for 51.63% of the region’s overall investment. The projects encompassed new roadways, bridge and underpass construction, road widening, and general upgrades to the transport network.

| Sr. No. | State | Project Nos. | Construction Value (INR-Crore) |

| 1 | Odisha | 23 | 16,552 |

| 2 | Jharkhand | 18 | 7,799 |

| 3 | Bihar | 13 | 5,994 |

| 4 | West Bengal | 7 | 1,711 |

| Total | 61 | 32,056 |

Key Stakeholders in the East Zone

This section highlights the key stakeholders driving road infrastructure activities in the East Zone during FY 2024-25. It focuses on major project owners and top contractors leading significant regional developments.

Major Project Owners

As of FY 2024-25, BX-2 tracked leading project owners in the East Zone, actively managing 61 road infrastructure projects valued at 32,056 INR-Crore. Of these, NHAI alone accounted for over 77.82% of the total project value. Other key players include:

| Sr. No. | Company Name | Project Nos. | Construction Value (INR-Crore) | % by Construction Value |

| 1 | National Highways Authority of India (NHAI) | 33 | 24,946 | 77.82% |

| 2 | Ministry of Road Transport and Highways (MORTH) | 13 | 2,649 | 8.26% |

| 3 | Government of Jharkhand | 8 | 1,668 | 5.20% |

Top General Turnkey/Civil Works Contractors

Biltrax’s BX-2 platform tracked 18 contractors during this period in the East zone that were involved in 21 roads and highways projects. These carry an accumulated construction cost of 4,583 INR-Crore. Agrawal Infrabuild Private Limited emerged at the top, spearheading a project worth 1,087 INR-Crore, representing nearly 23.72% of the cost. Bharat Vanijya Eastern Private Limited and Ram Kumar Contractor Private Limited followed in the second and third ranks, respectively. These firms are delivering projects worth 470 INR-Crore and 443 INR-Crore, respectively.

| Sr. No. | Company Name | Project Nos. | Construction Value (INR-Crore) | % by Construction Value |

| 1 | Agrawal Infrabuild Private Limited | 1 | 1,087 | 23.72% |

| 2 | Bharat Vanijya Eastern Private Limited | 2 | 470 | 10.26% |

| 3 | Ram Kumar Contractor Private Limited | 2 | 443 | 9.67% |

Additionally, BX-2 identified over 57 awarded contracts in the East region for FY 2024-25 with a combined awarded value of 26,939 INR-Crore and a total road length of 731 Km.

C. WEST ZONE

Construction Projects in the West Zone

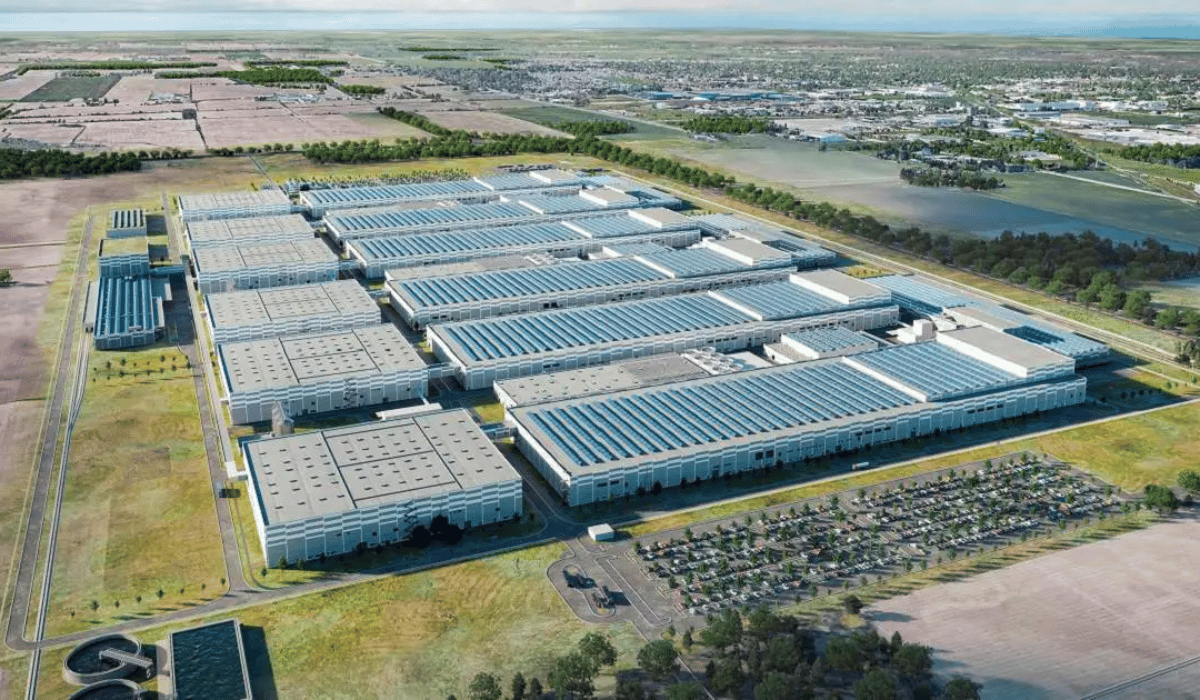

In the last financial year, Biltrax tracked 158 Roads & Highways projects in the West Zone through its BX-2 platform, with an estimated construction cost of 87,642 INR-Crore. Out of the 158 Roads and Highways projects identified in the West Zone, 129 were in the early stage of developments, while 29 were under construction. This also includes projects focused on upgrading existing road segments and minor structural enhancements.

State-wise Construction Overview of the West Zone

Of the total projects tracked by BX-2 in the West Zone during FY 2024-25, Maharashtra stood out with the highest construction value. The state undertook 143 projects with a combined construction cost of INR 81,912 Crore, accounting for 93.46% of the total in the region.

| Sr. No. | State | Project Nos. | Construction Value (INR-Crore) |

| 1 | Maharashtra | 143 | 81,912 |

| 2 | Gujarat | 10 | 3,560 |

| 3 | Goa | 5 | 2,170 |

| Total | 158 | 87,642 |

Key Stakeholders in the West Zone

This section highlights the key stakeholders driving road infrastructure activities in the West Zone during FY 2024-25. It focuses on major project owners and top contractors leading significant regional developments.

Major Project Owners

As of FY 2024-25, BX-2 tracked leading project owners in the West Zone, actively managing 158 road infrastructure projects valued at 87,642 INR-Crore. Of these, the MoRTH alone accounted for over 19.53% of the total project value. Other key players include:

| Sr. No. | Company Name | Project Nos. | Construction Value (INR-Crore) | % by Construction Value |

| 1 | Ministry of Road Transport and Highways (MoRTH) | 45 | 17,120 | 19.53% |

| 2 | Mumbai Metropolitan Region Development Authority (MMRDA) | 17 | 16,314 | 18.61% |

| 3 | Maharashtra State Infrastructure Development Corporation (MSIDC) | 42 | 14,304 | 16.32% |

Top General Turnkey/Civil Works Contractors

Among the 17 General turnkey/civil works companies monitored by BX-2 in the West zone, Afcons Infrastructure Limited led with projects worth 8,359 INR-Crore. This represented nearly 20.54% of the total construction value. Ashoka Buildcon Limited and Navayuga Engineering Company Limited followed in the second and third ranks, respectively. These firms delivered projects worth 4,454 INR-Crore and 2,596 INR-Crore, respectively.

| Sr. No. | Company Name | Project Nos. | Construction Value (INR-Crore) | % by Construction Value |

| 1 | Afcons Infrastructure Limited | 4 | 8,359 | 20.54% |

| 2 | Ashoka Buildcon Limited | 5 | 4,454 | 10.94% |

| 3 | Navayuga Engineering Company Limited | 2 | 2,596 | 6.38% |

Additionally, BX-2 identified over 153 awarded contracts in the West region for FY 2024-25 with a combined awarded value of 1,42,496 INR-Crore and a total road length of 1,515 Km.

Also Read: India’s Water Supply & Distribution Landscape in Q1 FY 2024-25

To conclude, FY 2024–25 has been a transformative year for India’s Roads & Highways sector in the North, East, and West zones. Strategic investments, flagship initiatives like Bharatmala and Gati Shakti, and the active engagement of major project owners and contractors have strengthened connectivity, enhanced freight efficiency, and supported regional economic growth. With hundreds of projects underway and significant financial outlays, these zones have set a strong foundation for the nation’s road infrastructure.

Stay tuned for our next article in the ‘Zonal Analytics’ series. In article 3 of 3, we will explore the South, Central and Northeast Zones – highlighting the critical segments of India’s construction industry.

Contact us today to learn more about how we can help you succeed in the construction industry.

Previous Articles

Next Article

- Part 3: South, Central, Northeast Zones

Biltrax Construction Data is tracking 37,000+ projects on their technology platform for their clients.

Get exclusive access to upcoming projects in India with actionable insights. Gain a further competitive advantage for your products in the Indian Construction Market.

Visit www.biltrax.com or email us at contact@biltrax.com to become a subscriber and generate leads.

Discover more from Biltrax Media, A Biltrax Group venture

Subscribe to get the latest posts sent to your email.