In this analysis, Biltrax Construction Data provides insights into the building construction landscape of the West Zone for FY 2024-25. This report focuses on residential, commercial, retail, hospitality, healthcare, and various miscellaneous structures documented through the BX-1 platform. It examines key trends and major players shaping the region’s construction industry.

Introduction

In this segment of our ‘Zonal Analytics‘ series, this article, part 4 of 7, focuses on the building construction landscape of the West Zone during FY 2024-25. Utilising Biltrax’s BX-1 platform, the analysis offers a detailed look at the region’s development activity across various sectors. These include residential, commercial, retail, hospitality, healthcare, data centers, educational institutions, multi-level car parks, entertainment hubs, religious buildings, and other miscellaneous structures.

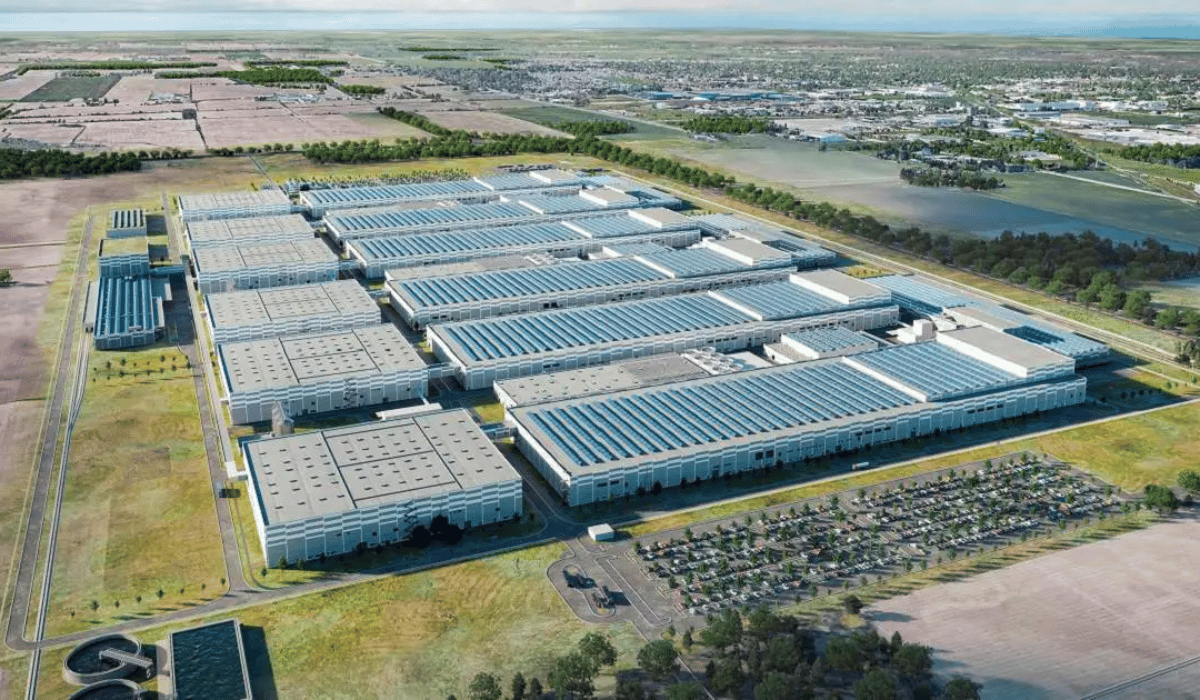

The West Zone, led by Maharashtra and Gujarat, continued to witness strong momentum in building construction activity. In Maharashtra, state-led initiatives such as the development of ‘Third Mumbai’ and integrated green data center parks are reshaping the urban landscape. Similarly, Gujarat is driving sectoral growth through policies like the Global Capability Center (GCC) framework and plans to establish Special Tourism Zones (STZs). These initiatives reflect a broader push towards diversified urban development, further positioning the region as a hub for economic activity and next-generation infrastructure.

In terms of development, the West Zone prioritised sustainable and future-ready construction. There was a noticeable shift towards the use of green materials and environmentally conscious technologies. Simultaneously, continued investments in digital infrastructure and smart city initiatives underscored the region’s commitment to intelligent urban growth.

Also Read: Building Construction Trends in India’s West Zone: FY 2023-24

Construction Projects in the West Zone

In FY 2024–25, Biltrax’s BX-1 platform tracked nearly 3,951 building projects across the West zone. These projects covered an aggregated construction area of 1,145 Million-SqFt, with an estimated construction cost of 436,637 INR-Crore. Notably, 1,185 projects were high-rise and luxury developments, accounting for 30% of the total count. As of July 2025, 2,694 projects are under construction, while 1,237 are in the pre-construction stage. The early-stage developments alone contribute nearly 55% of the total construction value, indicating a strong pipeline of future development in the region.

State-wise Construction Overview of the West Zone FY 2024-25 (Based on Construction Cost)

Of all building projects tracked on BX-1 across the West Zone during FY 2024–25, Maharashtra led in both project count and construction cost. The state accounted for approximately 74% of the zone’s total construction cost, reflecting a concentrated wave of building projects activity. The Mumbai Metropolitan Region (MMR) led with 1,315 projects, contributing 43% of the West zone’s total construction cost. Notably, around 160 projects in MMR have a construction cost above 250 INR-Crore, underscoring the region’s status as a major investment hub.

| State | Project Nos. | Construction Area (Million-SqFt) | Construction Cost (INR-Crore) |

| Maharashtra | 2,528 | 790 | 323,953 |

| Gujarat | 1,280 | 339 | 106,874 |

| Goa | 124 | 13 | 5,216 |

| Dadra & Nagar Haveli | 13 | 2 | 433 |

| Daman & Diu | 6 | 0.5 | 161 |

| TOTAL | 3,951 | 1,145 | 436,637 |

Building on the momentum of projects like ‘Third Mumbai’, the state moved forward with detailed planning for the 324 SqKm new town. This new city will feature sector-focused zones like Edu City and Medi City. Additionally, other zones will include Global Capability Centers (GCCs) and green Data Centers. Together, they aim to create self-sustaining, future-ready ecosystems for industry.

Meanwhile, CIDCO plans to build commercial hubs to attract corporate investments. These hubs will offer IT parks, office spaces, and service-sector buildings. Notably, they are linked to the Navi Mumbai International Airport’s growth corridor, reinforcing the region’s role as an investment magnet.

Meanwhile, Gujarat followed, contributing around 24% of the total cost (as tracked by Biltrax). The state is reinforcing its position as a future-ready economic powerhouse. It continues to anchor its urban strategy around marquee projects like Dholera Smart City (DSIR). This further integrates residential, commercial, and industrial zones under a sustainable development framework. Other standout initiatives include GIFT City in Gandhinagar and DREAM City in Surat, are designed to attract global capital and talent.

Complementing these physical developments, the Gujarat government introduced a policy to establish 250 Global Capability Centres (GCCs). This forward-looking move will attract over 10,000 INR-Crore in investments and create more than 50,000 new jobs. Furthermore, it reinforces Gujarat’s ambitions to become a key hub for technology, finance, engineering, analytics, and research services in India.

Sector-Wise Distribution

In FY 2024-25, BX-1 recorded 3,131 private sector building projects in the West Zone. These projects span a total construction area of 977 Million-SqFt and a construction cost of 375,004 INR-Crore. Pune led in terms of construction cost, contributing approximately 25% of the total private sector cost. Meanwhile, Mumbai and Thane followed closely.

Simultaneously, the public and public-private partnership sectors accounted for 820 projects, covering a construction area of 168 Million-SqFt with a total construction cost of 61,633 INR-Crore. This distribution reflected active participation from both private and public sectors, shaping the development narrative across the West Zone.

Key Stakeholders in the West Zone (Based on Construction Cost)

In this section, we highlight the prominent players that shaped the West zone’s construction landscape during FY 2024-25. The data focuses on Key Project Owners, Architects, MEP Consultants, Structural Engineering Consultants, and Contractors who played a pivotal role in advancing the region’s construction momentum during the fiscal year.

Major Project Owners

As of FY 2024-25, the West Zone witnessed strong construction momentum, with over 2,710 project owners actively executing more than 3,933 building projects. As tracked by BX-1, these developments were worth a total 419,185 INR-Crore of construction cost with a combined construction area of 1,139 Million-SqFt.

- Lodha Group (Macrotech Developers) led the private sector activity in Maharashtra during the last financial year. Biltrax tracked 11 ongoing and 4 upcoming projects of Lodha covering nearly 39 Million-SqFt. The total construction cost for these projects stood at 14,156 INR-Crore. Most of these developments fall under high-rise and luxury categories, indicating a focus on premium real estate.

- Public Works Department, Maharashtra (PWD) showcased a robust portfolio of 256 projects, during this period. The cumulative construction cost stood at 7,603 INR-Crore. Notably, 215 of these projects are small to mid-scale, each costing less than 50 INR-Crore.

- Krisala Developers undertook 5 projects, all located in Pune, Maharashtra. Together, they represented a significant construction cost of 6,863 INR-Crore. This highlights Pune’s emergence as a growing hub for high-value real estate activity.

| Sr. No. | Company Name | Project Nos. | Construction Area (Million-SqFt) | Construction Cost (INR-Crore) |

| 1 | Lodha Group (Macrotech Developers) | 15 | 39 | 14,156 |

| 2 | Public Works Department, Maharashtra (PWD) | 256 | 25 | 7,603 |

| 3 | Krisala Developers | 5 | 20 | 6,863 |

| 4 | Kalpataru Limited | 14 | 16 | 6,680 |

| 5 | Health and Family Welfare Department, Government of Gujarat | 50 | 20 | 6,642 |

| 6 | Sugee Group | 7 | 17 | 6,265 |

| 7 | Hiranandani Developers Private Limited | 1 | 17 | 6,109 |

| 8 | L&T Realty | 3 | 9 | 4,969 |

| 9 | Panchshil Realty | 4 | 10 | 4,563 |

| 10 | Hilton Hotels & Resorts | 2 | 8 | 4,368 |

| 11 | Directorate of Medical Education and Research (DMER) | 23 | 11 | 4,302 |

| 12 | Valor Estate (DB Realty Limited) | 2 | 9 | 4,225 |

| 13 | Maharashtra Housing and Area Development Board (MHADA) | 14 | 9 | 3,801 |

| 14 | Dosti Realty | 5 | 7 | 3,644 |

| 15 | Godrej Properties Limited | 6 | 8 | 3,521 |

| 16 | Kumar Properties | 7 | 9 | 3,307 |

| 17 | Kohinoor Group Pune | 7 | 8 | 3,307 |

| 18 | Deserve Group | 1 | 9 | 3,218 |

| 19 | Bajaj Finserv | 1 | 7 | 2,975 |

| 20 | Puravankara Projects Limited | 3 | 7 | 2,864 |

Top Design Architects and Consultants (Based on Construction Cost)

During FY 2024-25, BX-1 monitored 1,174 design architect firms in the West region. These are collectively executing over 2,399 building projects at an aggregated cost of 193,328 INR-Crore. The projects cover a combined construction area of 521 Million-SqFt.

VK:a Architecture lead the chart with 15 building projects all located in Maharashtra. Of these, 11 projects were worth over 100 INR-Crore. Architect Hafeez Contractor followed closely with 16 under construction and 5 upcoming projects. Meanwhile, A & T Consultants led third with 10 projects in Pune, Maharashtra.

| Sr. No. | Company Name | Project Nos. | Construction Area (Million-SqFt) | Construction Cost (INR-Crore) |

| 1 | VK:a Architecture | 15 | 26.55 | 9,569 |

| 2 | Architect Hafeez Contractor | 21 | 20.11 | 9,386 |

| 3 | A & T Consultants | 10 | 11.66 | 4,438 |

Top 3 Structural Engineering Consultants

BX-1 recorded 513 structural engineering consultancy firms actively working on 1,417 building projects across the West Zone in FY 2024-25. These projects covered a total construction area of 277.07 Million-SqFt, with an aggregated construction cost of 105,163 INR-Crore. JW Consultants LLP topped the list, handling 35 projects with a construction cost of 3,951 INR-Crore. Mahimtura Consultants Private Limited ranked second with 14 projects, followed by AVP Structural Consultants, working on 19 projects.

| Sr. No. | Company Name | Project Nos. | Construction Area (Million-SqFt) | Construction Cost (INR-Crore) |

| 1 | JW Consultants LLP | 35 | 17.6 | 7,333 |

| 2 | Mahimtura Consultants Private Limited | 14 | 5.42 | 2,485 |

| 3 | AVP Structural Consultants | 19 | 4.41 | 2,346 |

Top 3 MEP Consultants

BX-1 tracked 180 MEP consultants in the West Zone, delivering over 390 building projects with a combined construction area of 138.73 Million-SqFt and a total construction cost of 57,832 INR-Crore.

MEP Consulting Engineers lead the zone with 8 projects, with a construction cost is 3,126 INR-Crore. S N Joshi Consultants Private Limited ranked second with 5 projects, all located in Maharashtra. Meanwhile, Pankaj Dharkar & Associates stood third, executing 11 projects.

| Sr. No. | Company Name | Project Nos. | Construction Area (Million-SqFt) | Construction Cost (INR-Crore) |

| 1 | MEP Consulting Engineers | 8 | 6.22 | 3,126 |

| 2 | S N Joshi Consultants Private Limited | 5 | 7.73 | 2,891 |

| 3 | Pankaj Dharkar & Associates | 11 | 7.51 | 2,685 |

Top 3 General Turnkey/ Civil Works Contractors

During FY 2024-25, BX-1 documented 301 General Turnkey/Civil Works Contractors in the West zone. These are collectively delivering over 445 building projects at an aggregated cost of 25,042 INR-Crore. These projects covered a combined construction area of 62 Million-SqFt. BG Shirke Construction Technology Private Limited led with 9 building projects with a cumulative construction cost of 3,596 INR-Crore. Meanwhile, Harsh Constructions Private Limited and Harshvardhan Enterprises follow closely, each working on 7 projects.

| Sr. No. | Company Name | Project Nos. | Construction Area (Million-SqFt) | Construction Cost (INR-Crore) |

| 1 | BG Shirke Construction Technology Private Limited | 9 | 9.1 | 3,596 |

| 2 | Harsh Constructions Private Limited | 7 | 2.65 | 1,382 |

| 3 | Harshvardhan Enterprises | 7 | 0.38 | 110 |

Tendering and Awarded Contracts

In FY 2024-25, BX-1 identified over 922 tenders in the West zone. These tenders were linked to 932 projects with an aggregated cost of 43,075 INR-Crore. Maharashtra dominated in tender value, contributing 29,953 INR-Crore (nearly 70% in total). BX-1 recorded 700 tenders floated for the selection of contractors, with Maharashtra leading at 487 tenders. Additionally, 76 tenders were floated for the selection of owners, and 146 tenders were floated for consultants.

Additionally, BX-1 recorded 681 awarded contracts worth a total estimated 62,277 INR-Crore for 651 projects. Maharashtra accounted for the highest share with 595 awarded projects during FY 2024-25. BG Shirke Construction Technology Private Limited and Harsh Constructions Private Limited emerged as top awardees. Both companies secured 9 contracts each and are actively working in Maharashtra.

These insights underline the strategic value of zonal analytics in understanding regional construction dynamics. Through Biltrax’s real-time and in-depth analytics, stakeholders gain critical visibility into project pipelines, enabling them to make data-driven decisions.

Stay tuned for our next article in the ‘Zonal Analytics’ series, where we will delve into the construction projects in the South Zone, exploring another crucial part of India’s construction industry.

Contact us today to learn more about how we can help you succeed in the construction industry.

Previous Articles

Next Article

- Part 3: South Zone

Biltrax Construction Data is tracking 36,000+ projects on their technology platform for their clients.

Get exclusive access to upcoming projects in India with actionable insights. Gain a further competitive advantage for your products in the Indian Construction Market.

Visit www.biltrax.com or email us at contact@biltrax.com to become a subscriber and generate leads.

Discover more from Biltrax Media, A Biltrax Group venture

Subscribe to get the latest posts sent to your email.