This comprehensive analysis by Biltrax Construction Data delves into industrial construction trends in the West and South Zone for FY 2024-25. Leveraging data from the BX-2 platform, the report highlights the manufacturing and warehousing segments of the sector. It explores significant trends and the leading players driving construction activities in these regions.

Introduction

India’s industrial landscape reflects its vast geographical diversity, with each region playing a distinct role in the country’s economic growth. As part of our ‘Zonal Analysis, Series: 2’ (Part 3 of 4 – Industrial), this article focuses on these two pivotal zones – the West and South Zone. The West Zone strengthened its position as a leading industrial hub, fuelled by technology adoption, project expansions, and rising demand for modern warehousing. The South Zone, meanwhile, recorded strong momentum with investments across various industrial sub-segments. These included EVs, electronics, smart cities, data centers, steel, and power, underscoring its growing role in India’s industrial future.

This analysis examines the major developments and emerging trends in these regions during FY 2024–25 and highlights the growing contributions of both zones to India’s industrial growth story.

Overview

The West and South Zones both witnessed strong industrial growth in FY 2024–25, fueled by targeted policy interventions, increasing private sector participation, and stronger infrastructure connectivity. In the West Zone, Maharashtra and Gujarat spearheaded activity, with most project announcements. Their push in sectors like electric vehicles (EVs), semiconductors, specialty chemicals, and advanced engineering goods deepened the region’s industrial base. Maharashtra, for instance, benefitted from its Green Hydrogen Policy 2024, which attracted marquee investments in hydrogen-based mobility and chemicals, particularly in Pune and Aurangabad. Gujarat, on the other hand, gained momentum from its Semiconductor Policy 2024–29. This further led to major MoUs for chip fabrication plants in the Dholera Special Investment Region (SIR).

Beyond these, Warehousing added another layer of growth to the West Zone, with cities like Mumbai, Pune, Surat, and Ahmedabad emerging as key hubs. The surging demand for Grade-A warehousing, cold storage, and integrated logistics parks reflected the region’s manufacturing expansion and its role in meeting the needs of retail and e-commerce.

Similarly, the South Zone mirrored this momentum with consistent industrial expansion. Private and public investments, sector-focused policies, and manufacturing-led growth in electronics, EVs, and port-linked infrastructure supported this. Karnataka and Tamil Nadu emerged as flagbearers, accounting for a significant share of activity across quarters. Karnataka drove large-scale projects in EVs, aerospace, electronics, and precision manufacturing. Meanwhile, Tamil Nadu strengthened its auto and electronic components ecosystem and welcomed international players such as VinFast and Kaynes Technology. Telangana also advanced cluster-based development with MSME-centric industrial parks and gained traction in pan-India warehousing and logistics planning.

Also Read: India’s Building Construction Landscape in FY 2024-25

Part A: West Zone

Construction Projects in the West Zone

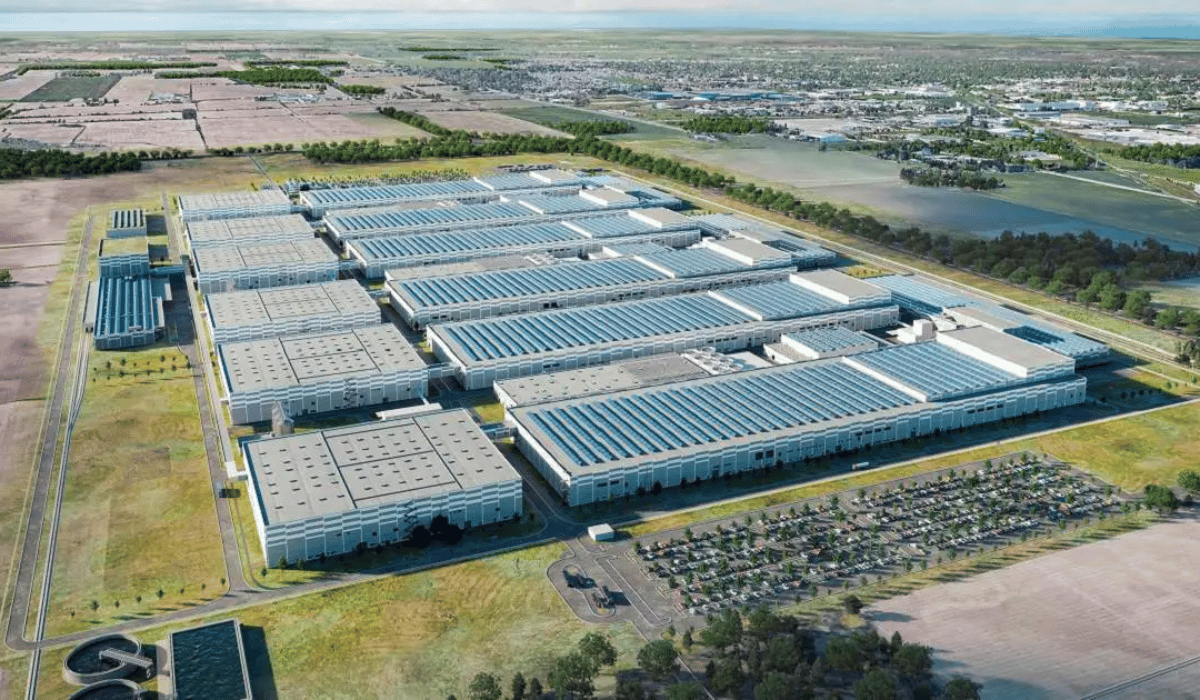

In the last financial year, Biltrax’s BX-2 platform tracked 1,122 industrial projects in the West Zone. These projects cover nearly 207.88 Million-SqFt, with an estimated investment cost of 317,039 INR-Crore.

State-wise Construction Overview of the West Zone (Based on Project Value)

Of the total projects tracked on BX-2 in the West region during FY 2024-25, Maharashtra led in terms of total project value and numbers. The state implemented 750 projects, spanning a total construction area of 130.86 Million-SqFt, valued at 228,306 INR-Crore. This represents 72% of the total project value in the West Zone. This growth was largely driven by the automobile and electronics manufacturing clusters in Pune, Aurangabad, and Talegaon, which continued to expand and attract fresh investments. A key highlight was Tata Electronics’ semiconductor plant in Pune, which moved into advanced construction stages during the year.

| Sr. No. | State | Project Nos. | Construction Area (Million-SqFt) | Project Value (INR-Crore) |

| 1 | Maharashtra | 750 | 130.86 | 228,306 |

| 2 | Gujarat | 334 | 71.28 | 85,700 |

| 3 | Goa | 24 | 4.51 | 1,622 |

| 4 | Daman | 7 | 0.95 | 1,070 |

| 5 | Dadra & Nagar Haveli | 7 | 0.28 | 341 |

| TOTAL | 1,122 | 207.88 | 317,039 |

Also Read: Navigating Building Construction Trends in India’s North Zone: FY 2024-25

% Market Share (Based on Project Value)

Simultaneously, Gujarat reinforced its leadership in large-scale industrial investments, particularly in chemicals, petrochemicals, and engineering goods. Major projects such as Reliance Industries’ petrochemical expansion in Jamnagar and Adani Group’s green hydrogen plant in Kutch progressed with significant civil and mechanical works. Additionally, the Sanand and Dahej industrial zones witnessed notable expansions in engineering components and industrial machinery manufacturing.

Major Sub-segments

In FY 2024-25, BX-2 tracked 191 projects from the top 5 sub-segments of the manufacturing sector in the West Zone. The Electronics sub-segment led in terms of project value with 59,676 INR-Crore, representing 20.06% of the total project value. The chemicals sub-segment led in terms of project numbers with 194 projects worth 41,564 INR-Crore, representing 13.97% of the total project value.

Major Sub-segments in the West Zone during FY 2024-25 (Based on Project value)

| Sr. No. | Sub-Segments | Project Nos. | Project Value (in INR-Crore) |

| 1 | Electronics | 83 | 59,676 |

| 2 | Chemicals | 194 | 41,564 |

| 3 | Solar Panels | 32 | 37,797 |

| 4 | Automobiles | 11 | 33,129 |

| 5 | Metal | 98 | 25,626 |

Key Stakeholders in the West Zone (Based on Project Value)

This section highlights the key stakeholders driving industrial construction activities in the West Zone during FY 2024-25. It focuses on major project owners, top contractors, and design engineering consultants leading significant developments across various sectors.

Major Project Owners

As of FY 2024-25, BX-2 monitored over 1,035 project owners in the West Zone. These firms were actively monitoring projects spanning 207.88 Million-SqFt, accounting to a total project value of 317,039 INR-Crore. The top 10 project owners alone accounted for nearly 41.45% of the total project value. Key players include:

| Sr. No. | Company Name | Project Nos. | Construction Area (Million-SqFt) | Project Value (INR-Crore) | % by Project Value |

| 1 | JSW Green Mobility Limited | 1 | 1.50 | 20,000 | 6.31 |

| 2 | Toyota Kirloskar Motor Private Limited | 1 | 2.00 | 16,000 | 5.05 |

| 3 | Vellore Information Technology Park Private Limited | 1 | 0.40 | 14,662 | 4.62 |

| 4 | Avaada Group | 1 | 0.10 | 14,000 | 4.42 |

| 5 | Skoda Auto Volkswagen India Private Limited | 1 | 2.00 | 13,000 | 4.10 |

| 6 | Hindalco Industries Private Limited | 2 | 0.48 | 12,584 | 3.97 |

| 7 | Powerin Urja India Private Limited | 1 | 0.35 | 11,474 | 3.62 |

| 8 | Viraj Profiles Private Limited | 3 | 1.18 | 10,096 | 3.18 |

| 9 | Vardhaan Lithium Private Limited | 1 | 8.61 | 10,000 | 3.15 |

| 10 | RRP Electronics Limited | 1 | 0.40 | 9,600 | 3.03 |

Top 5 General Turnkey/Civil Works Contractors

Of the 146 General turnkey/civil works companies monitored by BX-2 in the West zone, B M Constrotech Private Limited and Nitigya Buildcon Private Limited were the top firms in terms of project value. The firms are spearheading projects worth 20,120 INR-Crore and 20,000 INR-Crore, respectively. This covers 40.09% of the total project value mapped in the West Zone. Jepee Construction Private Limited is working on one high-value project, with a project value of 14,000 INR-Crore spanning over 0.10 Million-SqFt.

| Sr. No. | Company Name | Project Nos. | Construction Area (Million-SqFt) | Project Value (INR-Crore) | % by Project Value |

| 1 | B M Constrotech Private Limited | 2 | 1.53 | 20,120 | 20.11 |

| 2 | Nitigya Buildcon Private Limited | 1 | 1.50 | 20,000 | 19.99 |

| 3 | Jepee Construction Private Limited | 1 | 0.10 | 14,000 | 13.99 |

| 4 | Suroj Buildcon Private Limited | 4 | 3.13 | 8,039 | 8.03 |

| 5 | ITD Cementation India Limited | 1 | 0.41 | 8,000 | 7.99 |

Top 5 Design Engineering Consultants

Among the 193 Design Engineering consultancy firms were monitored by BX-2 during FY 2024-25, VMS Engineering & Design Services Private Limited (VMS Consultants Ahmedabad) led in terms of project value. This firm alone covers 15.51% of the total project value. Archivista Engineering Projects Private Limited and Designers Combine rank second and third, with 15 and one high value project, respectively. The top ten companies alone account for 65.23% of the total project value.

| Sr. No. | Company Name | Project Nos. | Construction Area (Million-SqFt) | Project Value (INR-Crore) | % by Project Value |

| 1 | VMS Engineering & Design Services Private Limited (VMS Consultants Ahmedabad) | 20 | 3.50 | 15,962 | 15.51 |

| 2 | Archivista Engineering Projects Private Limited | 15 | 4.48 | 14,335 | 13.93 |

| 3 | Designers Combine | 1 | 8.61 | 10,000 | 9.72 |

| 4 | Jacobs CES Consulting Engineering Services India Private Limited | 3 | 1.28 | 7,314 | 7.11 |

| 5 | Tata Consulting Engineers Limited | 7 | 6.58 | 6,364 | 6.18 |

Part B: South Zone

Construction Projects in the South Zone

In the last financial year, Biltrax tracked nearly 1,144 industrial projects in the South Zone through its BX-2 platform. These projects cover more than 165.39 Million-SqFt, with an estimated project value of 263,682 INR-Crore.

State-wise Construction Overview of the South Zone (Based on Project Value)

% Market Share (Based on Project Value)

Of the total industrial projects tracked on BX-2 in the South region during FY 2024-25, Telangana led in terms of total project value. The state implemented 343 projects covering an area of 35.33 Million-SqFt, having a total project value of 88,540 INR-Crore. Telangana’s warehousing segment gained ground with emphasis on public-private parks and MSME-centric industrial clusters in the last financial year. Karnataka ranked second in terms of project value. Meanwhile, Tamil Nadu ranked second in terms of number of projects. The top three states alone accounted for more than 87% of the zone’s overall project value.

Tamil Nadu witnessed a sharp rise in demand for industrial space, led by logistics, electronics, and automobile sectors, particularly around Chennai. The state strengthened this momentum with dedicated policies for semiconductors and PPP-led infrastructure development. Meanwhile, Karnataka’s industrial growth accelerated following the Global Investors’ Meet, which generated MoUs worth over 10.27 Lakh INR-Crore. These were generated across core and sunrise sectors such as electronics, defence, aerospace, and electric mobility. Additionally, the government introduced the Karnataka Industrial Policy 2025–30, targeting 7.5 Lakh INR-Crore in investments and the creation of 20 Lakh jobs. The policy placed a strong emphasis on green and advanced manufacturing, ESDM, aerospace, and defence, further consolidating the state’s industrial base.

| Sr. No. | State | Project Nos. | Construction Area (Million-SqFt) | Project Value (INR-Crore) |

| 1 | Telangana | 343 | 35.33 | 88,540 |

| 2 | Karnataka | 293 | 62.5 | 79,890 |

| 3 | Tamil Nadu | 314 | 43.21 | 63,225 |

| 4 | Andhra Pradesh | 128 | 18.46 | 25,273 |

| 5 | Kerala | 60 | 5.29 | 5,919 |

| 6 | Pondicherry | 6 | 0.6 | 835 |

| TOTAL | 1,144 | 165.39 | 263,682 |

Major Sub-segments

In FY 2024-25, the South region experienced significant developments across various industrial sub-segments, reflecting diverse and robust growth. BX-2 recorded 519 projects across major sub-segments of the manufacturing sector in this zone. These projects encompass a total project value of 139,658 INR-Crore. The electronics sub-segment led the way with INR 57,385 crore across 124 initiatives. Moreover, the food-processing segment recorded the highest volume of projects; 161 in total, amounting to INR 25,224 crore.

Major Sub-segments in the South Zone during FY 2024-25 (Based on Project value)

| Sr. No. | Sub-Segments | Project Nos. | Project Value(in INR-Crore) |

| 1 | Electronics | 124 | 57,385 |

| 2 | Food Processing | 161 | 25,224 |

| 3 | Automobiles | 30 | 16,378 |

| 4 | Chemicals | 82 | 14,422 |

| 5 | Steel | 23 | 13,209 |

| 6 | Miscellaneous | 99 | 13,040 |

Large-scale food processing clusters were proposed in Tamil Nadu’s southern districts of Theni and Dindigul. Meanwhile, demand from export-oriented MSMEs surged in sectors such as seafood, dairy, and spices. Tamil Nadu and Telangana together led project activity in the food processing sub-segment. Telangana further strengthened its position by promoting integrated food processing parks under the Telangana Mega Food Park Policy.

Key Stakeholders in the South Zone (Based on Project Value)

Major Project Owners

As of FY 2024–25, BX-2 tracked over 1,077 project owners actively involved in the South Zone’s industrial landscape. Together, they are executing more than 1,144 industrial projects valued at an estimated 263,682 INR-Crore. Notably, the top 10 project owners contributed over 45% of the total project value. Prominent players include:

| Sr. No. | Company Name | Project Nos. | Construction Area (Million-SqFt) | Project Value (INR-Crore) | % by Project Value |

| 1 | BYD India Private Limited | 1 | 1.5 | 50,000 | 18.96 |

| 2 | Yuzhan Technology India Private Limited | 1 | 0.75 | 12,000 | 4.55 |

| 3 | Hero Future Energies Limited | 1 | 0.25 | 10,000 | 3.79 |

| 4 | Tata Motors Limited | 1 | 0.56 | 9,000 | 3.41 |

| 5 | Jaguar Land Rover India Limited | 1 | 0.56 | 9,000 | 3.41 |

| 6 | Premier Energies Limited | 7 | 3.82 | 7,735 | 2.93 |

| 7 | Emmvee Photovoltaic Power Private Limited | 1 | 0.45 | 6,000 | 2.28 |

| 8 | Shree Cement Limited | 4 | 1.3 | 5,810 | 2.20 |

| 9 | Phoenix Kothari Footwear Limited | 5 | 1.5 | 5,530 | 2.10 |

| 10 | JR One Kothari Footwear Private Limited | 5 | 1.5 | 5,530 | 2.10 |

Top 3 General Turnkey/Civil Works Contractors

Among the 107 General turnkey/civil works companies monitored by BX-2 in the South zone, Amara Raja Infra Private Limited led, with projects worth 5,080 INR-Crore. This represented nearly 14.19% of the total project value. The firm is actively developing a total of 0.53 Million-SqFt of the construction area. Hankuk Construction & Trading Private Limited and China Construction Sausum India Private Limited followed in the second and third ranks, respectively. These firms are delivering projects worth 4,000 INR-Crore and 2,250 INR-Crore, respectively.

| Sr. No. | Company Name | Project Nos. | Construction Area (Million-SqFt) | Project Value (INR-Crore) | % by Project Value |

| 1 | Amara Raja Infra Private Limited | 2 | 0.53 | 5,080 | 14.19 |

| 2 | Hankuk Construction & Trading Private Limited | 1 | 0.9 | 4,000 | 11.18 |

| 3 | China Construction Sausum India Private Limited | 2 | 2.53 | 2,250 | 6.29 |

| 4 | Yonah Engineering Private Limited | 1 | 1.9 | 2,000 | 5.59 |

| 5 | Sathlokhar Synergys Private Limited | 7 | 1.46 | 1,670 | 4.67 |

Top 5 Design Engineering Consultants

Among 124 Design Engineering consultancy firms monitored by BX-2, of these CR Narayana Rao Architects & Engineers manage the highest number of projects. The firm managed 17 projects worth 3,679 INR-Crore. In contrast, Tata Consulting Engineers Limited oversaw only 4 high-value projects but led in terms of project value, contributing a substantial 11,650 INR-Crore.

| Sr. No. | Company Name | Project Nos. | Construction Area (Million-SqFt) | Project Value (INR-Crore) | % by Project Value |

| 1 | Tata Consulting Engineers Limited | 4 | 2.33 | 11,650 | 19.51 |

| 2 | RCT Solutions GmbH | 4 | 3.5 | 7,300 | 12.23 |

| 3 | Mecon Limited | 2 | 1 | 4,177 | 7.00 |

| 4 | CR Narayana Rao Architects & Engineers | 17 | 4.71 | 3,679 | 6.16 |

| 5 | RSB Arch Project Consultants Private Limited | 9 | 3.35 | 2,417 | 4.05 |

Also Read: Navigating Building Construction Trends in India’s East Zone: FY 2024-25

This article summarizes an in-depth analysis of industrial trends for FY 2024-25 in the West & South zones, offering insights into growth and development. In conclusion, zonal analytics play a pivotal role in deciphering these regional dynamics. Offering further insights that are essential for stakeholders to navigate the complex construction landscape. By leveraging data from Biltrax, industry players gain access to detailed, real-time information on construction projects across India. Moreover, with Biltrax’s robust analytics and detailed reporting, stakeholders can effectively plan and execute their projects, ensuring they are aligned with regional demands and opportunities. This approach not only enhances efficiency but also drives sustainable growth in India’s dynamic construction sector.

Stay tuned for our next article in the ‘Zonal Analytics’ series. In the final article, we will explore the Central and Northeast Zones – another critical segment of India’s construction industry.

Contact us today to learn more about how we can help you succeed in the construction industry.

Previous Articles

Next Article

Biltrax Construction Data is tracking 36,000+ projects on their technology platform for their clients.

Get exclusive access to upcoming projects in India with actionable insights. Gain a further competitive advantage for your products in the Indian Construction Market.

Visit www.biltrax.com or email us at contact@biltrax.com to become a subscriber and generate leads.

Discover more from Biltrax Media, A Biltrax Group venture

Subscribe to get the latest posts sent to your email.