This report provides a regional overview of India’s industrial sector for FY 2024-25, with a particular focus on the manufacturing and warehousing segments. These segments, documented by Biltrax Construction Data (hereafter referred to as Biltrax) through the BX-2 platform, explore key trends and major players influencing the region’s construction industry.

Introduction

India’s industrial sector is a dynamic and integral part of the nation’s economic framework, playing a crucial role in driving growth and development. Spanning a wide range of sub-segments, it fuels innovation, supports large-scale employment, and makes a significant contribution to the country’s GDP. Key sub-segments include manufacturing, logistics and warehousing, aerospace and defense, food and beverage, rubber and plastics, textiles and apparel, renewable energy, and consumer goods.

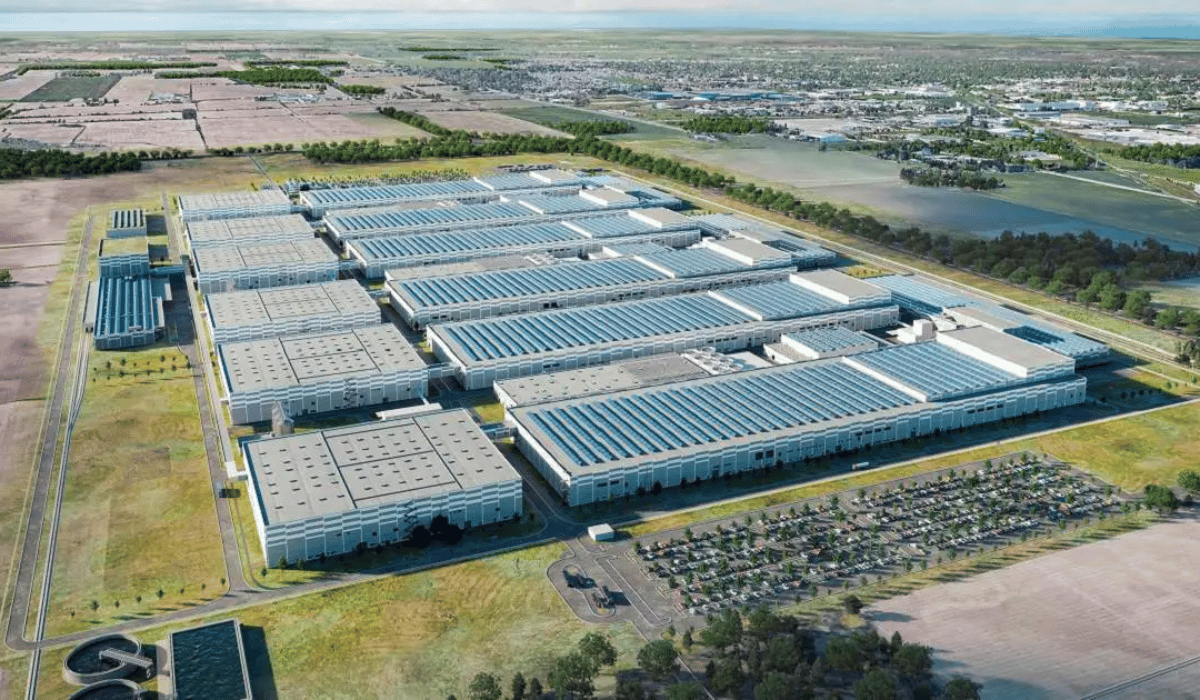

The manufacturing segment in India significantly contributes to the country’s economic growth. It drives industrial expansion and boosts exports. During the last financial year (FY 2024-25), the government launched several new initiatives, and investors actively established new manufacturing hubs and factories. The private sector, led by PLI schemes, invested heavily in segments like electronics, auto components, and pharmaceuticals. The Index of Industrial Production (IIP) consistently grew, with monthly increases averaging 4–6% year-on-year. States such as Gujarat, Maharashtra, Uttar Pradesh, and Tamil Nadu developed new manufacturing hubs. Meanwhile, leading companies like Tata Steel, ITC, and Reliance Industries played a major role in strengthening the manufacturing sector.

Meanwhile, in the warehousing segment, the demand remained strong, led by the rapid expansion of sectors like e-commerce, manufacturing, and third-party logistics (3PL). Companies continued to seek larger, more efficient storage spaces. This further resulted in the growth of modern logistics parks, especially in cities like Mumbai, Pune, and Chennai. A key trend this year was the rise of automation and technology integration. Many new facilities adopted smart systems for real-time inventory management and rapid order fulfillment. Sustainability also remained a major focus, with more warehouses featuring green building certifications, solar energy setups, and water-saving systems. These innovations not only support environmental goals but also help companies save on long-term operational costs.

Also Read: India’s Building Construction Landscape in FY 2024-25

BX-2

Biltrax’s BX-2 platform is a comprehensive resource for non-building projects across India. It covers diverse segments such as Roads & Highways, Industrial/Manufacturing, Warehousing, and Water Supply & Distribution. Our dedicated team of analysts meticulously tracks and monitors industrial projects within this extensive framework. BX-2 tracks over 22,801 projects, offering detailed information on construction volumes, geographies, roles and specializations, project durations, etc. By leveraging the platform, stakeholders gain valuable insights and strategic advantages, facilitating informed decision-making and efficient project execution in India’s dynamic construction sector.

As we progress, we will discuss the specific analytics for each zone, providing actionable insights drawn from our extensive data platform.

Biltrax tracks projects zone-wise, as elaborated below

– North Zone – Delhi, Haryana, Himachal Pradesh, Jammu & Kashmir, Punjab, Rajasthan, Uttar Pradesh, Uttarakhand, Chandigarh, Ladakh.

– East Zone – Andaman & Nicobar Islands, Bihar, Jharkhand, Odisha, West Bengal.

– West Zone – Dadra & Nagar Haveli, Daman & Diu, Goa, Gujarat, Maharashtra.

– South Zone – Andhra Pradesh, Karnataka, Kerala, Lakshadweep, Pondicherry, Tamil Nadu, Telangana.

– Central Zone – Madhya Pradesh, Chhattisgarh.

– North East Zone – Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura.

Also Read: Driving Growth & Success – Biltrax’s Mission & Vision for the Construction Industry

Utilizing Biltrax Construction Data for Strategic Insights

Analyzing regional dynamics through zonal analytics empowers stakeholders to make well-informed decisions and uncover opportunities specific to each zone’s distinctive attributes.

Biltrax plays a pivotal role in tracking and analyzing construction projects across India. As of August 2025, Biltrax monitors 59,411+ live construction projects. These encompass more than 17.02 Billion-SqFt of construction area and a total estimated project value of 11,556,362 INR-Crore (approximately 1.39 US$-Trillion). During FY 2024-25, BX-2 documented 4,214 industrial projects (manufacturing+warehousing), covering 687.10 Million-SqFt & 1,155,367 INR-Crore of project value.

Our zonal analysis for the last financial year highlights diverse construction activities across India’s six zones. Among these, the East Zone led with the highest project value (349,440 INR-Crore), encompassing a total construction area of 106.85 Million-SqFt. The West Zone followed closely, with projects covering 207.89 Million-SqFt of construction area having a total project value of 317,039 INR-Crore.

| Zone | Project Nos | Construction Area (Million-SqFt) | Project Value (INR-Crore) |

| East | 540 | 106.85 | 349,440 |

| West | 1,122 | 207.89 | 317,039 |

| South | 1,144 | 165.39 | 263,682 |

| North | 1,018 | 130.67 | 146,692 |

| Central | 298 | 66.81 | 69,144 |

| North-East | 92 | 9.49 | 9,370 |

| TOTAL | 4,214 | 687.10 | 1,155,367 |

Major Sub-segments

During FY 2024-25, BX-2 tracked 3,829 industrial projects across prominent sub-segments of the manufacturing sector. Collectively, these projects covered a construction area of 603.94 Million-SqFt, with a total project value of 1,060,863 INR-Crore.

Among the various sub-segments, the steel sector dominated in terms of capacity expansion and brownfield project activity. The segment led in terms of project value, contributing 15.56% of the total. This was largely due to robust domestic demand, increased infrastructure spending, and rising exports. Major players such as JSW Steel, Tata Steel, and SAIL initiated significant expansions to cater to infrastructure projects related to roads, railways, bridges, and urban housing. The government’s continued focus on the National Infrastructure Pipeline (NIP) and capital outlay for core sectors further boosted the steel industry’s prospects.

Meanwhile, the Electronics sector followed closely, contributing 15.48% to the overall project value across all zones. This surge was largely driven by the Production Linked Incentive (PLI) scheme, which attracted domestic and foreign investments into mobile phone assembly, semiconductor units, and component manufacturing. Key states that concentrated on these projects included Tamil Nadu, Karnataka, and Uttar Pradesh.

| Sr. No. | Sub-segments | Project Nos. | Project Value (in INR-Crore) | % by Project Value |

| 1 | Steel | 178 | 179,790 | 15.56% |

| 2 | Electronics | 382 | 178,816 | 15.48% |

| 3 | Solar Panels | 84 | 127,520 | 11.04% |

| 4 | Metal | 415 | 105,923 | 9.17% |

| 5 | Chemicals | 386 | 98,538 | 8.53% |

Also Read: Maharashtra Housing Policy 2025: What it means for the Construction Sector

In summary, India’s manufacturing sector continues to evolve as a key driver of economic growth, fueled by rising investments, technological advancements, and government policy support. With strong momentum across core industries and an increasing focus on infrastructure and capacity expansion, the sector is well-positioned for sustained and transformative growth in the years ahead. Given the sector’s alignment with national priorities like ‘Make in India‘ and decarbonization goals, stakeholders should prioritize investments in energy-efficient technologies, automation, and integrated logistics ecosystems.

Biltrax’s robust analytics and detailed reporting enable construction material manufacturers and investors to effectively plan and execute their strategies. This ensures alignment with regional demands and opportunities. Such an approach enhances efficiency and drives sustainable growth in India’s dynamic construction sector.

Comprehensive Regional Insights

To further explore industrial construction trends and developments in specific zones during FY 2024-25, please refer to the following detailed reports:

- Part 2: North and East Zones – Discover insights into industrial developments and trends in these regions. Read more here.

- Part 3: West and South Zones – Explore significant industrial trends and developments in these areas. Explore the report.

- Part 4: Central and Northeast Zones – Access a detailed analysis of the industrial sector’s performance and key projects in these zones. Access the analysis.

Contact us today to learn more about how we can help you succeed in the construction industry.

References: Biltrax Construction Data (BX-2 Platform), Central Statistics Office, FICCI, Economic Survey of India, Media sources, Ministry of Skill Development and Entrepreneurship, Union Budget 2024-25, Press Information Bureau, IBEF Annual Reports.

Biltrax Construction Data is tracking 36,000+ projects on their technology platform for their clients.

Get exclusive access to upcoming projects in India with actionable insights. Gain a further competitive advantage for your products in the Indian Construction Market.

Visit www.biltrax.com or email us at contact@biltrax.com to become a subscriber and generate leads.

Discover more from Biltrax Media, A Biltrax Group venture

Subscribe to get the latest posts sent to your email.